Tips to Speed Up Your Pet Insurance Reimbursement

You’ve just faced an emergency vet visit. Your dog swallowed something he shouldn’t have, or your cat came home limping. After the stress, the treatment, and the invoice, you breathe a little easier knowing you have pet insurance.

But now comes the next challenge — waiting for your money back.

If you’ve ever found yourself refreshing your banking app and wondering when that payment will come through, you’re not alone. While pet insurance is a valuable safety net, the reimbursement process can sometimes feel like it drags on forever.

This guide is here to change that. Below, you’ll find proven, practical tips to help you get a faster pet insurance reimbursement, avoid common mistakes, and make the entire claims journey as smooth as possible.

Whether you’re a first-time policyholder or a seasoned pet parent, these insights will help you take control of your claims and get your quick pet claim payouts — without the headache.

How Pet Insurance Reimbursement Works

Before we dive into the shortcuts, let’s quickly recap how pet insurance usually operates.

Unlike human health insurance (where the provider often pays the doctor directly), most UK pet insurance works on a reimbursement model:

- You pay your vet directly at the time of treatment

- You submit a claim to your insurer

- They assess it based on your policy

- You receive a reimbursement (minus any excess or co-pay)

Depending on the insurer and how efficiently you handle your paperwork, this can take anywhere from 2 days to 3 weeks.

Let’s look at how you can get to the shorter end of that scale.

1. Know Your Policy Inside and Out

Understanding your policy is step one. It sounds basic, but many delays happen because the claim is for something the policy doesn’t cover, or not in the way the pet parent expected.

Key things to check:

- Waiting periods for illnesses or accidents

- Claim submission deadlines (typically 90–180 days from treatment)

- Policy limits and exclusions

- Pre-authorisation rules for expensive or elective procedures

- Whether your vet qualifies under the policy

Pro tip: Highlight or bookmark the claims section in your policy document for quick reference.

2. Submit Your Claim ASAP

Time is of the essence.

The faster you file your claim, the faster it gets processed. Insurers are less likely to delay a claim that’s fresh and supported by recent documentation.

Here’s what to do:

- File your claim the same day or week as the vet visit

- Keep all receipts and invoices from your vet

- Snap a photo or scan immediately — don’t wait until you’re home

Most modern insurers like ManyPets, Waggel, and Petplan offer app or portal submissions — use them. They’re quicker and reduce the risk of missing info.

3. Use Insurers with Digital Claims

Let’s be honest: snail mail slows everything down.

If you want quick pet claim payouts, choose a provider that accepts digital submissions — ideally through a user-friendly app.

Look for:

- App-based claims (e.g. Waggel, ManyPets)

- Upload functionality for invoices and medical records

- Real-time claim tracking

- Automated pre-filled forms linked to your policy

Real-life example: Claire submitted her claim through the ManyPets app with a photo of her vet invoice. It was approved and paid out within 3 working days. There was no paper, no phone calls—just a tap and a few clicks.

4. Prepare All Documentation Upfront

The number one cause of claim delays? Missing documents.

Insurers often need:

- An itemised invoice from your vet

- Full clinical notes or medical history (especially for first-time or major claims)

- A completed claim form (sometimes signed by your vet)

If anything’s missing, your insurer will pause the claim and request it, adding days or even weeks.

What you can do:

- Ask your vet for everything before you leave the clinic

- Use a checklist:

- Diagnosis

- Date of treatment

- Itemised costs

- Vet’s name and contact info

- Keep digital copies of all past claims and medical notes

Bonus tip: If your vet is submitting directly to the insurer, follow up with them to confirm it’s sent correctly.

5. Stick with One Vet (if Possible)

Continuity helps your insurer track your pet’s medical history. If you bounce between clinics, it may raise red flags or require extra verification.

Insurers are more likely to fast-track your claim if:

- The vet is familiar with your pet’s history

- There’s no gap in records

- They have a consistent view of your pet’s health

If you use more than one vet (e.g. an emergency clinic + your regular one), make sure all records are shared and up to date.

6. Understand Pre-Authorisations

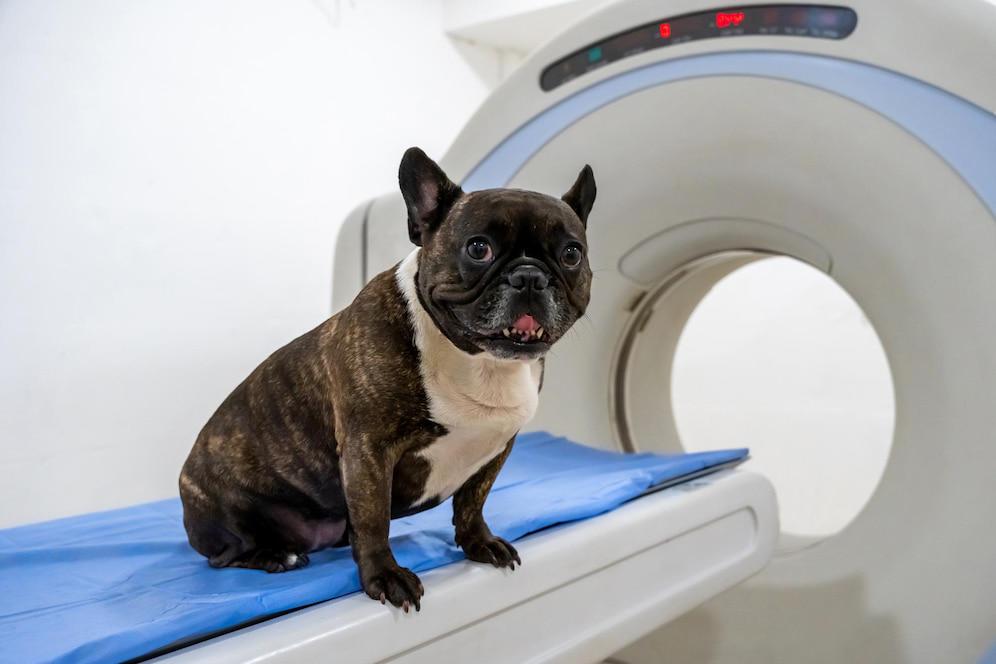

Some treatments — like surgeries, MRIs, or specialist visits — require pre-approval.

Failing to get one can result in:

- A delayed claim

- A denied claim

- Out-of-pocket costs you didn’t expect

How to speed it up:

- Ask your vet to submit a treatment plan ahead of time

- Get written confirmation from your insurer

- Keep emails or reference numbers as proof

Pre-authorisation may seem like a hassle upfront, but it makes reimbursement smoother and gives you confidence to proceed with costly care.

7. Be Clear and Consistent with Info

Small mismatches in the information you provide can trigger manual reviews, which means delays.

Double-check:

- Pet’s name (use what’s on the policy, not a nickname)

- Dates (treatment date vs. invoice date)

- Spelling of conditions and vet practice details

- Your policy number

If anything looks unclear or inconsistent, your claim may be set aside for manual investigation. We’re trying to avoid that.

8. Follow Up (But Don’t Spam)

If you haven’t heard anything within 5–7 working days (or whatever your insurer quotes), a polite follow-up can help move things along.

Best practices:

- Include your claim reference number

- Keep the tone friendly

- Ask if they need anything else to process the claim

- Don’t send repeated messages — one prompt is often enough

Sometimes a simple nudge puts your claim back at the top of the queue.

9. Choose the Right Insurer

Not all pet insurers are created equal. If you’re repeatedly facing slow payouts, it might be time to switch.

Look for providers with:

- High customer satisfaction on Trustpilot or Feefo

- Clear average claim processing times

- App-based submissions and live updates

- Transparency around exclusions and excesses

Highly rated for fast claims:

- ManyPets

- Waggel

- Petplan (for higher-end policies)

- Bought By Many

When researching, look for recent reviews — policies and service levels change over time.

10. Keep a Pet Insurance Tracker

It doesn’t have to be fancy. Just a simple spreadsheet or notes file to record:

- Claim submission date

- Treatment details

- Claim amount

- Reimbursement received

- Notes or email exchanges with your insurer

This helps you spot delays early, chase missing payments, and stay organised if you need to challenge or appeal a claim.

Real-World Example: Fast Claim in Action

Dan’s terrier, Max, needed stitches after cutting his paw. The vet bill came to £720.

Here’s what Dan did right:

- Submitted his claim that evening via his insurer’s app

- Uploaded the invoice and requested vet notes on the same day

- Included his policy number and a clear explanation of the accident

He was reimbursed within 4 days.

Dan’s advice? “Treat it like a job application. Be thorough, be fast, and follow up politely.”

Common Mistakes That Slow Claims Down

Avoid these if you want speedy payouts:

- Waiting weeks to submit your claim

- Uploading blurry or incomplete documents

- Forgetting to include the vet’s invoice

- Mixing up treatment and invoice dates

- Using a nickname instead of the pet’s official name

- Ignoring pre-authorisation requirements

- Not checking email for requests from your insurer

Conclusion: Get Paid Faster, with Less Stress

Filing a pet insurance claim doesn’t have to be a slow, painful process. With a little organisation, clear communication, and smart timing, you can dramatically cut down the wait for your faster pet insurance reimbursement.

Let’s recap the keys to speed:

- Know your policy — especially waiting periods and limits

- Submit your claim quickly and completely

- Use digital apps or portals wherever possible

- Get all the documents from your vet at once

- Follow up gently and keep records

A few simple habits can mean the difference between a smooth payout and a stressful delay.